Innovative and Safe Next Gen Payment Methods for Businesses

The pandemic brought about 2 years of shifting working and shopping habits to largely online increasing the ability of most consumers to navigate the world through a digital lens This led many businesses to adopt an omnichannel commerce strategy sinc

The rapid evolution of the financial technology industry has increased the preference of consumers to pay using their smart devices, taking advantage of features like buy now pay later(BNPL), contactless payments, and cryptocurrencies.

Banking and financial institutions are under the most pressure to compete with new players entering the market. In this article, we will explore the recent innovations in the field of payments that have led to an increase in competition among businesses.

Innovative and Safe Next Gen Payment Methods for Businesses

In 2020, at the beginning of the pandemic, there was a shift in how customers paid. For the first time ever, card-not-present transaction volume surpassed card-present(CNP), and the shift has not gone back to pre-pandemic levels.

Digital wallets

This mode of payment allows users to link their credit and debit cards, and bank accounts directly to an online account of their choice e.g. PayPal, Payzen, Google Wallet, etc.

They have all of the users' payment information conveniently stored in one place providing extra security. This ensures that the vendor receiving the payment never receives their credit card information.

QR-code payments

This mode of payment is contactless since it allows a customer to make a payment by scanning a QR code via a mobile app. It is an alternative to making an electronic funds transfer at a POS (Point of Sale) using a terminal. This helps businesses avoid a lot of infrastructures such as payment networks, merchant accounts, payment terminals and payment cards traditionally associated with electronic payments.

Buy now pay later

This is a short-term financing payment method that allows customers to make purchases, often interest-free then make payments at a future date.

It is becoming a popular payment option, especially when doing online shopping. The terms vary from business to business but generally operate on the following terms;

- You make a purchase at a participating business and opt for buy now, pay later at checkout.

- Once approved, you make a small down payment, such as 25% of the overall purchase amount.

- You then pay off the remaining amount due in a series of interest-free installments.

- The payments can be made via a check or bank transfer or can be deducted on any preferred payment method accepted by the business automatically.

Mobile point of sale

This is a revolutionary technology that frees businesses from their brick-and-mortar locations and in-store payments and allows them to go to various places like food trucks, trade shows, concerts and many other places where they can accept payments seamlessly.

This is possible since an mPOS (Mobile Point of Sale) system turns any tablet or smartphone into a checkout point and allows a merchant to track inventory, collect business data, calculate total sales, process payments, and many other options are available to the merchant's fingertips.

Mobile credit card payments

This is a payment method that only requires a business to have a mobile credit card reader that is attached directly to a smartphone and it works like any in-store credit card machine except it is portable and only requires a corresponding app e.g. iZettle, Square, PayPass, paywave and many others.

Cryptocurrencies

This article would not be complete without the honorable mention of cryptocurrencies as a payment method. This quickly growing payment method allows for businesses to receive payments through a crypto-payment gateway that processes digital currencies.

Crypto-gateway companies remove any uncertainties one might have with cryptocurrency and also take on the extra work of exchanging cryptocurrency and managing your wallet out of your hands but it is worth noting they are not required. Customers can make payments from their crypto wallet to the business' wallet directly without the need of involving a 3rd party e.g. via a merchant's crypto-address or by quickly scanning a QR code that automates the process.

Why should businesses adopt these next-gen payment methods?

Reach more customers

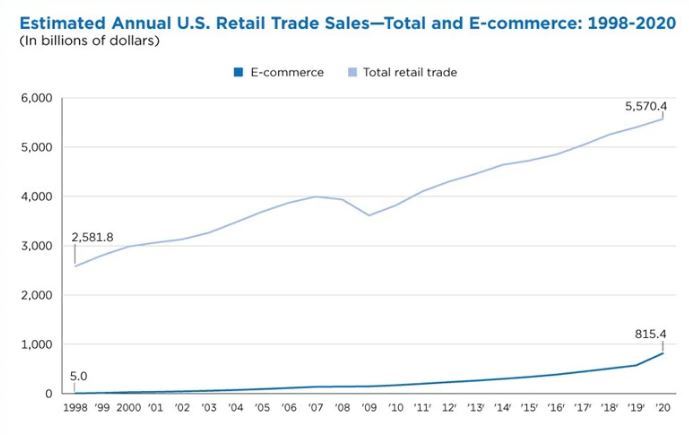

Online shopping has improved the ability of both large and small businesses to reach more customers and this can be reflected by the rise in numbers from 2019 to 2020 where the consumers who either browsed or shopped online in the US grew from 209.6 million to more than 230.5 million in 2021.

Sell more

It is no doubt that the introduction of e-commerce is driving sales. A report by the US Census Bureau estimated that e-commerce sales increased by $224.2 billion (43%) in 2020.

Enhance security

Many E-commerce solutions have incorporated enhanced payment security measures to help protect against data breaches and fraud following the migration of EMV(Europay, MasterCard, Visa) which raised concerns about fraudsters targeting online transactions.

Increase productivity

By adopting easy online payment methods, businesses can reduce or eliminate manual tasks such as managing customer disputes, data entry and processing paper invoices. This saves a lot of time and effort allowing businesses to focus on core activities.

What are the risks involved with Next-Gen payment methods?

Shopping cart abandonment

The average rate of shopping cart abandonment is very high, standing at 69.23%. This is because leaving a website without completing a purchase is as easy as online shopping itself.

Businesses can adopt various methods to help reduce this e.g. simplifying the checkout process, informing customers about shipping and return policies upfront, sending reminder emails to customers who have not completed their checkout, providing easy customer service, and many other methods.

Fraud

An increase in online spending has increased the potential for fraud since thieves always follow the money. Businesses can implement payment security technologies and best practices to help prevent and reduce instances of fraud.

Some of the best practices businesses can adopt to reduce fraud include being diligent about passwords (e.g. changing default passwords, not sharing passwords, granting systems access to select individuals), ensuring firewalls are in place, and keeping antivirus protection up to date.

Chargebacks

While some merchants may view chargebacks as simply a cost of doing business, they can result in big losses to a company's bottom line, as well as to their reputation. They may occur due to a few reasons like fraudulent activity or when a customer does not receive an order or the order does not satisfy them.

How to mitigate risks involved with cryptocurrency payments.

The evolution of payment methods has led to the gain in momentum of adoption of virtual currencies as a legitimate form of payment. It is increasingly important for businesses to understand the risks and opportunities associated with these products since the ultimate success will depend on their ability to control the risks.

So, how can one mitigate risks?

- Placing specific limits on funding

- Specifying the parties and methods authorized to fund accounts

- Specifying the nature of the legal tender used to fund the accounts

- Monitoring the frequency of loads to the account

- Applying enhanced and ongoing due diligence on merchants, and monitoring for their compliance with regulatory

Conclusion

While there is no denying that PayPal is the reigning champion when it comes to receiving payments, technology has opened the door for a number of competitors to challenge them by offering cheaper fees, faster transactions, and enhanced security. It is my hope that this article has been an eye-opener for you and your business about some of these next-generation methods. If you found this article helpful, visit our consultation services for more articles like this.